Google Pixel 8 Pro Price in Nigeria

The Google Pixel 8 Pro stands as the purest expression of Android, combining Google’s industry-leading AI with exceptional camera technology in a premium package. In Nigeria, where Google has no official presence and the device exists solely through parallel imports, the Pixel 8 Pro represents a paradox: a phone celebrated globally for its computational photography and AI features, yet one that operates in the shadows of Nigeria’s smartphone market. Understanding its price, availability, and value requires navigating a complex import ecosystem and comparing its niche appeal against global accessibility.

This comprehensive guide delivers a complete analysis of the Pixel 8 Pro’s pricing in Nigeria across all variants, compares it with 11 leading tech economies where it’s officially sold, and provides crucial advice for Nigerian enthusiasts daring to venture into this unofficial but technologically rewarding territory.

Google Pixel 8 Pro Price in Nigeria: Complete Breakdown

The Reality of an Unofficial Market

Google does not sell Pixel phones officially in Nigeria, nor does it authorize any distributors. Every Pixel 8 Pro in the country arrives through parallel import channels, creating a market characterized by scarcity, premium pricing, and buyer caution. Here are the current market realities:

Pixel 8 Pro Storage Variants (Parallel Import Pricing):

-

128GB: ₦850,000 – ₦1,050,000

-

256GB: ₦950,000 – ₦1,150,000

-

512GB: ₦1,150,000 – ₦1,350,000

Color Availability & Premiums:

-

Bay (Light Blue): Most common, base pricing

-

Obsidian (Black): Limited stock, ₦20,000-₦40,000 premium

-

Porcelain (White): Rarest, ₦50,000-₦80,000 premium when available

-

Mint (Green, Japan exclusive): Occasionally appears at ₦100,000+ premium

Condition-Based Market Segments:

-

Brand New Sealed: 95% of claimed “new” are actually refurbished/resealed

-

Open Box (Like New): Actual new devices opened for customs/verification

-

Refurbished/Grade A: 5-10% cheaper, require expert verification

-

Used Market: Virtually non-existent due to low sales volume

Critical Factors Influencing Pixel 8 Pro Pricing in Nigeria

1. Extreme Scarcity & Import Rarity:

-

No official supply chain means each unit is individually imported

-

Limited to travelers, specialized importers, and tech enthusiasts

-

Each color/storage combination requires specific sourcing

2. Network Compatibility Concerns:

-

Pixel devices historically have band compatibility issues in Nigeria

-

8 Pro improved but still missing some 4G bands used by Nigerian carriers

-

Potential buyers must verify compatibility with their specific network

3. Zero Official Support Infrastructure:

-

No warranty recognition whatsoever

-

No authorized repair centers

-

No access to official accessories

-

Software updates dependent on original region firmware

4. Niche Enthusiast Demand:

-

Purchased primarily by Android purists, developers, photographers

-

Status as “forbidden fruit” increases desirability among tech elite

-

Community of owners is small but highly knowledgeable

5. AI & Camera Reputation:

-

Tensor G3 chip with dedicated AI processing

-

Industry-leading computational photography

-

Magic Editor, Best Take, Audio Magic Eraser features

-

Seven years of software updates (unprecedented in Android)

Sourcing Channels & Verification Requirements

Primary Import Channels:

-

UK Travel Imports: Most common source, UK models work reasonably well in Nigeria

-

US Travel Imports: Cheaper source but more network compatibility issues

-

Japan Imports: Exclusive colors, shutter sound mandatory, rare in Nigeria

-

Germany/EU Imports: Good network compatibility, higher prices

Verification Protocol for Nigerian Buyers:

-

IMEI Check: Verify original sales region and carrier lock status

-

Bootloader Status: Check if bootloader is unlockable (important for enthusiasts)

-

Band Compatibility Test: Insert local SIM and test all networks

-

Physical Inspection: Look for signs of refurbishment/resealing

-

Feature Test: Verify all cameras, AI features, and connectivity work

Where “Not” to Buy:

-

General Marketplaces: Jumia, Konga (high risk of refurbished sold as new)

-

Unverified Social Media Sellers: Instagram, WhatsApp dealers without physical address

-

Computer Village General Stalls: Most don’t understand Pixel specifics

Global Google Pixel 8 Pro Price Comparison: 11 Tech Powerhouses

1. United States (Primary Market)

Pixel 8 Pro 128GB: $999 (Official Google Store)

Nigerian Price: ₦850,000 – ₦1,050,000

Premium Analysis: Nigeria pays 15-42% LESS than US retail price (surprising but explained by import dynamics)

Key Factor: US models often carrier-locked; Nigerian imports typically unlocked international versions

2. United Kingdom (Major European Market)

Pixel 8 Pro 128GB: £999 (approx. $1,260 / ₦1,120,000)

Nigerian Price: ₦850,000 – ₦1,050,000

Premium Analysis: Nigeria pays 0-24% LESS than UK retail price

Best For: Nigerian importers favor UK models for better network compatibility

3. Germany (EU Hub Market)

Pixel 8 Pro 128GB: €999 (approx. $1,082 / ₦960,000)

Nigerian Price: ₦850,000 – ₦1,050,000

Premium Analysis: Nigeria pays 0-12% LESS than Germany

Note: German/EU models have 2-year mandatory warranty (not applicable in Nigeria)

4. Japan (Unique Feature Set)

Pixel 8 Pro 128GB: ¥139,800 (approx. $931 / ₦825,000)

Nigerian Price: ₦850,000 – ₦1,050,000

Premium Analysis: Nigeria pays 3-27% premium

Consideration: Japanese models have mandatory, un-disableable camera shutter sounds

5. Canada (North American Alternative)

Pixel 8 Pro 128GB: CAD 1,299 (approx. $959 / ₦850,000)

Nigerian Price: ₦850,000 – ₦1,050,000

Premium Analysis: Nigeria pays 0-24% premium

Market Reality: Very few Canadian models reach Nigeria due to distribution patterns

6. Australia (Pacific Region)

Pixel 8 Pro 128GB: AUD 1,699 (approx. $1,103 / ₦980,000)

Nigerian Price: ₦850,000 – ₦1,050,000

Premium Analysis: Nigeria pays 0-13% LESS than Australia

Feature: Australian models identical to UK/EU versions

7. Singapore (Asian Tech Hub)

Pixel 8 Pro 128GB: SGD 1,399 (approx. $1,036 / ₦920,000)

Nigerian Price: ₦850,000 – ₦1,050,000

Premium Analysis: Nigeria pays 0-14% LESS than Singapore

Distribution: Singapore models occasionally appear via returning students/professionals

8. India (Newly Launched Market)

Pixel 8 Pro 128GB: ₹1,06,999 (approx. $1,289 / ₦1,145,000)

Nigerian Price: ₦850,000 – ₦1,050,000

Premium Analysis: Nigeria pays 0-26% LESS than India

Recent Development: Google’s official India launch has created new import channel

9. France (European Market)

Pixel 8 Pro 128GB: €1,059 (approx. $1,147 / ₦1,020,000)

Nigerian Price: ₦850,000 – ₦1,050,000

Premium Analysis: Nigeria pays 0-17% LESS than France

Network Note: French models identical to other EU versions

10. United Arab Emirates (Not Officially Sold)

Market Status: Not officially available

Nigerian Price: ₦850,000 – ₦1,050,000

Gray Market: Devices appear via re-export from UK/Europe

Dubai Reality: Surprisingly difficult to find genuine Pixels in Dubai markets

11. South Korea (Not Officially Sold)

Market Status: Not officially available

Nigerian Price: ₦850,000 – ₦1,050,000

Import Reality: Virtually no Korean models in Nigeria due to language/network differences

Global Summary: Nigeria’s Pixel 8 Pro pricing is surprisingly competitive against official markets, primarily because importers source from cheapest available regions and the low volume minimizes speculative pricing.

Technical Specifications: Risk-Reward Analysis for Nigerian Users

Pixel 8 Pro’s Standout Features

1. Tensor G3 with Titan M2 Security:

-

Google’s custom chip optimized for AI/ML tasks

-

Titan M2 security coprocessor for hardware-level security

-

Efficient performance with focus on AI rather than raw benchmarks

2. Camera System & Computational Photography:

-

50MP main + 48MP ultra-wide + 48MP telephoto (5x optical)

-

Pro-level controls with manual ISO, shutter speed, white balance

-

Magic Editor: AI-powered object manipulation in photos

-

Best Take: Combines multiple shots for perfect group photo

-

Audio Magic Eraser: Removes background noise from videos

3. Display Technology:

-

6.7-inch LTPO OLED (1-120Hz adaptive refresh)

-

Super Actua Display (2400 nits peak brightness)

-

Always-on display with At a Glance information

-

Corning Gorilla Glass Victus 2 front and back

4. Software & Update Commitment:

-

Seven years of OS and security updates (through 2030)

-

Pure Android experience without manufacturer bloatware

-

First access to new Android features and AI capabilities

-

Guaranteed Feature Drops every quarter

5. AI-Exclusive Features:

-

Call Screen with direct my call

-

Hold for Me during customer service calls

-

Live Translate in messages and apps

-

Gemini Nano on-device AI (coming via update)

Storage Recommendations for Nigerian Pixel Users

128GB (₦850,000 – ₦1,050,000):

-

For: Light users, those heavily reliant on Google Photos cloud

-

Nigerian Reality: Risky due to expensive mobile data for cloud backup

-

Recommendation: Only for those with reliable home/office WiFi

256GB (₦950,000 – ₦1,150,000):

-

For: Most Nigerian Pixel buyers, balances cost and practicality

-

Nigerian Reality: Recommended minimum given limited cloud reliance

-

Resale Consideration: Most sought-after configuration if reselling

512GB (₦1,150,000 – ₦1,350,000):

-

For: Photographers, content creators, those keeping device 4+ years

-

Nigerian Reality: Overkill for most, but future-proofs for seven-year update promise

-

Market Presence: Rarely imported due to low demand at this price point

Economic Analysis: The Niche Buyer’s Profile in Nigeria

Who Actually Buys Pixel Phones in Nigeria?

Primary Buyer Segments:

-

Android Developers & Tech Professionals: Need pure Android for development/testing

-

Photography Enthusiasts: Value computational photography over other features

-

Google Ecosystem Loyalists: Heavy users of Google services wanting optimal integration

-

Tech Early Adopters: Want something different from mainstream Samsung/Apple

-

Returning Diaspora: Nigerians returning from countries where Pixel is officially sold

Income Profile of Typical Nigerian Pixel Buyer:

-

Monthly Income: Typically ₦800,000+ (upper-middle class and above)

-

Tech Literacy: High – comfortable with troubleshooting without official support

-

Alternative Devices Owned: Usually has primary iPhone or Samsung flagship

-

Purchase Motivation: 70% camera/software features, 30% status/unique device

The True Cost of Ownership in Nigeria

Beyond Purchase Price:

-

Import Risk Premium: Factored into price but unpredictable

-

Self-Support Time: Hours spent troubleshooting without official help

-

Repair Costs: When broken, parts must be imported, repairs expensive

-

Resale Value Depreciation: Steep due to niche market and no warranty

-

Opportunity Cost: Money that could have bought supported premium device

Comparative Cost Analysis (Over 3 Years):

-

Pixel 8 Pro 256GB: ₦1,050,000 + ₦150,000 potential repairs = ₦1,200,000

-

Samsung S24+ 256GB: ₦950,000 + ₦50,000 repairs = ₦1,000,000 (with warranty)

-

iPhone 15 256GB: ₦1,100,000 + ₦100,000 repairs = ₦1,200,000 (better resale)

Market Trends and Future Predictions

Nigerian Pixel Market Evolution

Current State (2024):

-

Estimated 200-300 Pixel 8 Pro units in entire country

-

Primary concentration in Lagos (90%), Abuja (8%), other cities (2%)

-

Active WhatsApp/Telegram groups for Pixel owners (total members: ~500)

-

Zero service infrastructure, community-dependent support

2024-2025 Outlook:

-

Google Africa Expansion Rumors: Possible Kenya/South Africa launch could benefit Nigeria

-

Increased Import Channels: More Nigerians studying/working abroad may bring devices

-

Used Market Development: As early adopters upgrade, used market may emerge

-

Accessory Availability: Remains poor unless imported individually

Long-Term Possibilities:

-

Official Launch: Unlikely before 2026-2027 if ever

-

Authorized Service: Potential if enough units enter market

-

Community Growth: Steady but slow expansion of enthusiast base

Critical Considerations for Nigerian Importers

1. Network Band Compatibility:

-

MTN Nigeria: Mostly compatible but may miss some 4G bands

-

Airtel Nigeria: Good compatibility, best network for Pixel users

-

Glo: Variable performance, not recommended

-

9mobile: Limited compatibility, avoid

2. Software & Update Realities:

-

Updates arrive based on original purchase region

-

Changing SIM doesn’t affect update schedule

-

Potential for delayed updates if Google detects “abnormal” location patterns

-

No region switching without advanced technical knowledge

3. Repair & Parts Ecosystem:

-

Screen Replacement: ₦250,000-₦350,000 if parts available

-

Battery Replacement: ₦80,000-₦120,000 (parts scarcity issue)

-

Motherboard Issues: Essentially irreparable in Nigeria

-

Camera Repair: Possible but requires imported parts and expertise

Expert Recommendations for Nigerian Buyers

Should You Even Consider a Pixel 8 Pro in Nigeria?

Only Consider If You:

-

Are technically proficient and comfortable without support

-

Value photography/AI features above all else

-

Have alternative communication device if Pixel fails

-

Can afford the device as a “luxury/enthusiast” purchase

-

Have traveled or have trusted contacts in Pixel markets

Avoid If You:

-

Need reliable daily driver for business/essential communication

-

Expect warranty or official support

-

Frequently travel outside major cities where network issues may compound

-

Are not comfortable troubleshooting Android issues independently

-

View phone as investment with good resale value

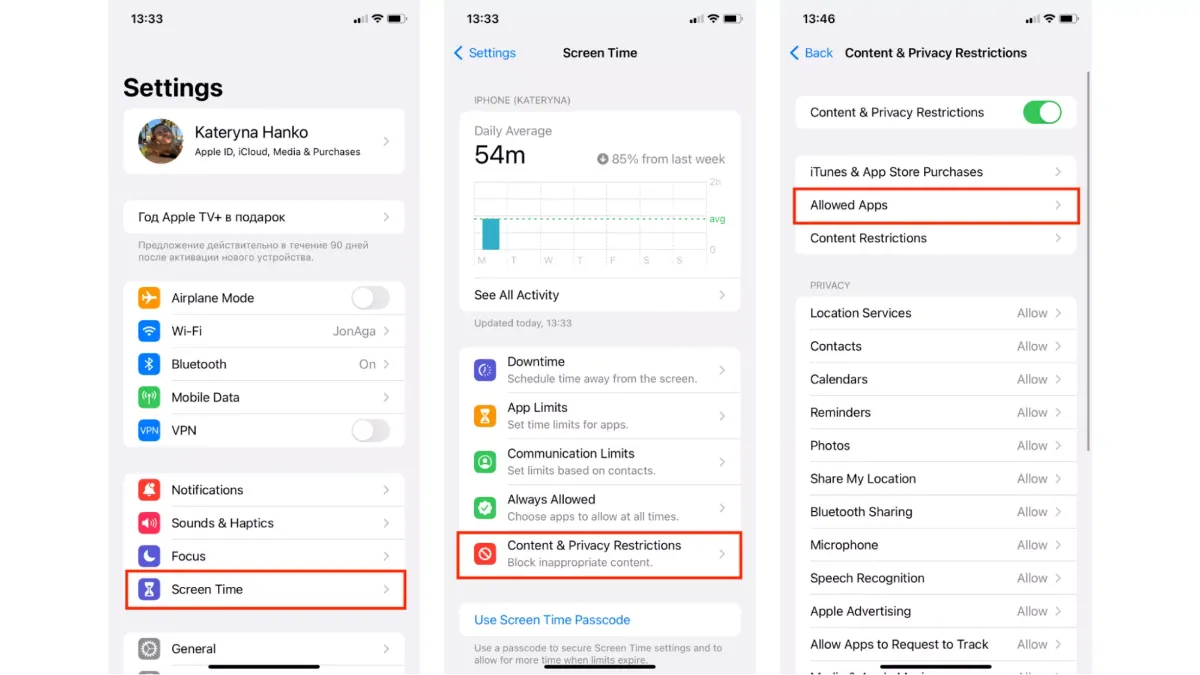

If Proceeding: Purchase Protocol

Step 1: Source Verification

-

Prefer UK models for best Nigeria compatibility

-

Require original purchase receipt (digital acceptable)

-

Verify IMEI through multiple online services

-

Physically inspect before payment

Step 2: Immediate Testing

-

Test with your actual SIM cards

-

Verify all cameras and microphones

-

Test WiFi, Bluetooth, GPS

-

Check for dead pixels on display

-

Verify charging works with multiple chargers

Step 3: Community Integration

-

Join Nigerian Android/Pixel enthusiast groups

-

Identify experienced repair technicians beforehand

-

Download necessary tools/software for potential troubleshooting

-

Establish relationship with seller for future inquiries

Optimal User Strategy in Nigeria

Dual Device Approach (Recommended):

-

Primary Device: Reliable iPhone or Samsung for calls/messaging/business

-

Secondary Device: Pixel 8 Pro for photography, experimentation, leisure

-

Benefit: Minimizes risk while enjoying Pixel’s strengths

Single Device Strategy (High Risk):

-

Ensure you have backup basic phone

-

Invest in premium case and screen protector immediately

-

Purchase from seller who offers 7-14 day return window

-

Have repair budget allocated from start

Alternatives Worth Considering in Nigeria

For Photography Focus:

-

iPhone 15 Pro: Better supported, excellent cameras, similar price

-

Samsung S24 Ultra: Superior zoom, better support, S Pen

-

Xiaomi 13 Pro/14 Pro: Leica partnership, better availability, lower price

For Pure Android Experience:

-

Nothing Phone (2): Unique design, good performance, growing support

-

OnePlus 12: Near-stock Android, excellent performance, better availability

-

Samsung with Good Lock: Customizable to near-stock experience

For AI/Software Features:

-

Samsung Galaxy S24 Series: Galaxy AI features, better implementation in Nigeria

-

iPhone 15 Series: iOS AI features, better ecosystem integration

-

Wait for Future: Pixel 9 series might have better global compatibility

Conclusion: The Calculated Risk of Pixel Ownership in Nigeria

The Google Pixel 8 Pro represents the ultimate test of a Nigerian tech enthusiast’s dedication. It offers arguably the best smartphone camera system available, the purest Android experience, and an unprecedented seven-year update promise. Yet, it delivers these in a package completely unsupported in the Nigerian context, creating a paradox of premium technology without a safety net.

For the right Nigerian buyer—technically skilled, financially secure, and philosophically aligned with Google’s vision—the Pixel 8 Pro can deliver immense satisfaction. Its computational photography capabilities are genuinely class-leading, its AI features are thoughtfully implemented, and its software experience is refreshingly clean.

However, for the vast majority of Nigerian smartphone buyers, the risks overwhelmingly outweigh the rewards. The lack of warranty, repair infrastructure, network optimization, and resale value make it a poor choice as a primary device. The premium paid for this imported technology doesn’t translate to premium support or peace of mind.

The Pixel 8 Pro in Nigeria serves as a fascinating case study in global technology distribution gaps. It highlights how even in our connected world, geography still determines access and support. For Nigerian consumers, it underscores the importance of considering the entire ecosystem—not just the device specifications—when making premium technology investments.

As Nigeria’s tech market continues to mature and global brands recognize its potential, perhaps future Pixel generations will receive official support. Until then, the Pixel 8 Pro remains a beautiful, capable, but fundamentally compromised choice for all but the most dedicated and prepared Nigerian users.